Disclosure: This site is sponsored by affiliate programs. We may earn money from the companies mentioned in this post. As an Amazon affiliate partner we may earn from qualifying purchases.

PS: Use my refer-a-friend code joshburnstech when signing up for Collective to get your first month free (a $297-$349 value).

My guide below provides an in-depth review of my experience using Collective to restructure my business as an S Corporation (S Corp).

I’ve used Collective for about eight months after initially thinking I wasn’t going to use it at all. Now I’m about to upgrade to an annual plan – that’s how much Collective has helped me as an entrepreneur and freelancer.

If you’re like me, stick around to learn Collective’s features, benefits, and drawbacks. I’ll also dig deeper into the differences between LLC and S Corp and help you understand how you’ll be taxed better.

Let’s see if Collective is the right choice for your entrepreneurial journey.

The most comprehensive Collective review and tutorial for beginners on YouTube

What is Collective?

Collective is a super handy, all-in-one financial platform designed specifically for self-employed entrepreneurs. They help you set up and run your business as an LLC with S-Corp taxation, all managed completely online.

What’s really cool is that they assign you a personal CPA (called a member relationship manager or MRM) who handles everything from bookkeeping to payroll. My MRM is Kaylie and she's such a nice and genuinely helpful person.

Fun fact: The platform was created by freelancers who understood the struggles of managing business finances. On average, members making over $80k annually save around $10,000 in taxes!

Why I Decided to Use Collective.com

Before discovering Collective, I faced challenges with local accountants who lacked the flexibility and accessibility that I needed.

Honestly, the traditional approach felt overwhelming—especially when it came to understanding complex tax requirements. We’ve all been there, right?

A friend and a fellow freelancer then recommended Collective after her positive experience, which ultimately led me to try their services. The convenience of managing everything online through a user-friendly dashboard was a huge factor in my decision.

LLC vs S Corp

Listen, I’m not a CPA or a Tax Advisor. Like you, I’m just an entrepreneur looking to grow/manage my business the right way. I recently learned that knowing the difference between an LLC and an S Corp is part of that process.

| Aspect | LLC | S Corp |

|---|---|---|

| Legal Structure | Protects personal assets from business debts | Provides tax benefits and savings |

| Taxation | Taxed as a sole proprietor unless elected otherwise | Pass-through taxation for income |

| Self-Employment Tax | Subject to self-employment tax on all profits | Can reduce self-employment tax liability |

Takeaway: An LLC serves primarily as a legal protection mechanism. An S Corp designation, however, can lead to significant tax savings. It allows owners to pay themselves a reasonable salary and take additional profits as distributions.

Note: After paying yourself a reasonable salary, you can take additional profits as distributions. These distributions are not subject to self-employment taxes, only to federal and state income taxes.

Starting an S-Corp: Opening a Business Account and Choosing a Credit Card

If you haven’t already, your top priority when starting an S Corp is setting up a dedicated business account and credit card (optional).

I waited way too long to move my business transactions from my personal bank account to a business bank account. The longer you wait, the more problems co-mingling funds will cause for you.

From experience, both Chase and American Express offer solid business accounts. For credit cards though, consider these top options with great perks:

- American Express Blue Business Cash (0% annual fee, 1-2% cashback)

- Chase Ink Business Cash (0% annual fee, 1-5% cashback)

- Chase Ink Business Unlimited (1.5% cashback on all purchases)

Pro Tip: Start transitioning all your business income and expenses to these accounts immediately. Move your subscriptions, client payments, and regular expenses to your business accounts to make bookkeeping much simpler.

S-Corp Reasonable Salary

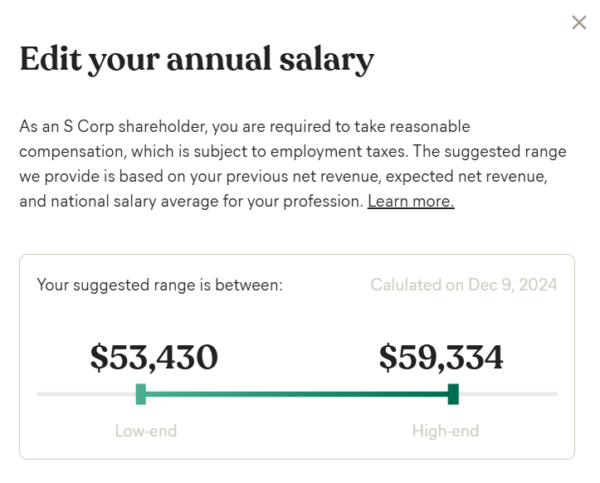

Collective’s CPAs help you determine the right salary percentage (typically 40-60% of your income) to stay IRS-compliant.

Since income often fluctuates throughout the year, they’ll remind you to review and adjust your salary bi-annually based on your business performance. Their experts analyze your earnings and provide recommended salary ranges to keep you on track.

What Collective Offers

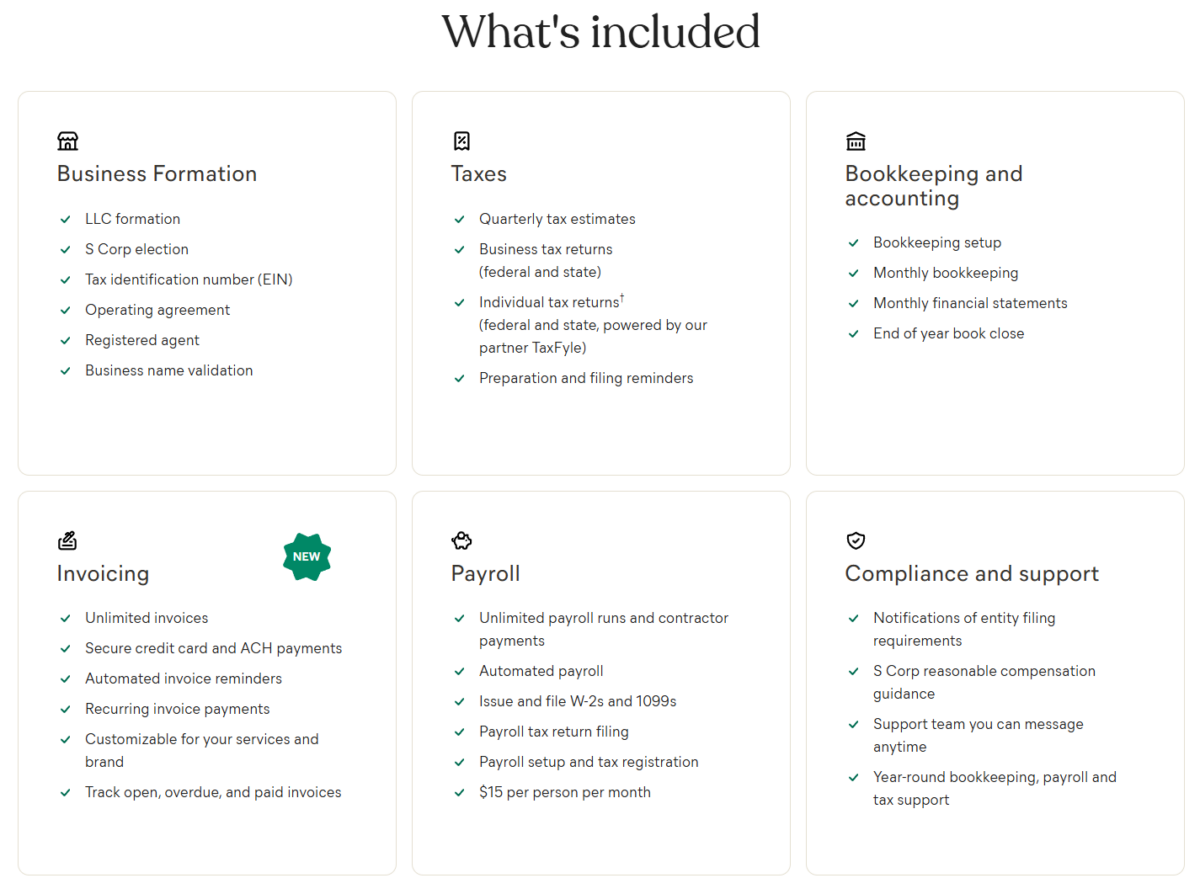

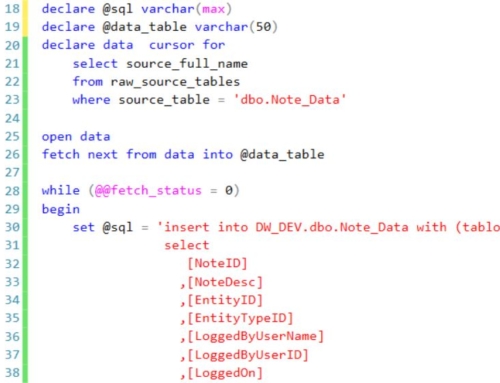

If your business is just starting out, Collective helps set up your LLC and obtain your EIN (tax ID). For established businesses, they’ll handle your S Corp election by filling out Form 2553 with the IRS.

They also manage your quarterly tax estimates, sending you both federal and state payment amounts. You can pay these online and simply upload the receipts to your Collective dashboard.

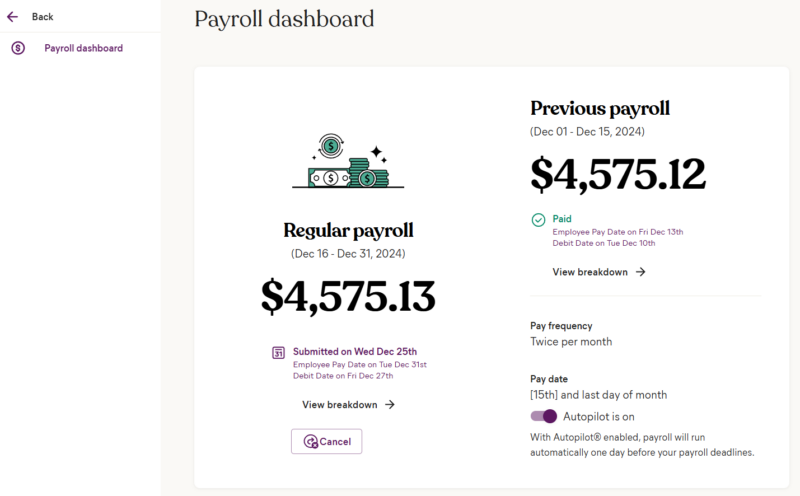

For the tax season, Collective handles your business tax returns. You also get year-round bookkeeping, payroll through Gusto (included with your membership), and expert accounting support.

Even more, they handle monthly transaction categorization, and bank reconciliation, and provide detailed financial reports.

Sounds overwhelming? Don’t worry! Your dedicated MRM manages everything from payroll runs to W-2 filings. They’ll train you on using their systems and review your financial reports monthly. My MRM, Kaylie, is always happy to help me figure things out!

Pros of Using Collective

- The onboarding process while time-consuming (took me 2 months to complete) was super smooth

- Helps you obtain an IRS EIN and register your LLC (if you haven't already)

- New members join a 45-minute member kick-off webinar led by a CPA (that they also record)

- Accounting and payroll user-friendly setup

- One-on-one meet-up with a Collective Tax Advisor (shows you how to categorize, read profit and loss statements, handle payroll…etc.)

- The Collective Dashboard keeps all transactions and information in one place and online

- Quick and reliable communication (typical response ETA is 24-48 hrs)

- Connecting you to a payroll specialist (also helps with set up a solo 401k)

Cons of Using Collective

- They don’t work with multi-member LLCs (only single member)

- No built-in messaging in the Collective Dashboard (only communication is through email threads)

- No mobile app

Heads up! Check out my Collective Dashboard Demo to help you navigate it like a pro.

Get Your First Month With Collective For Free

Ready to try Collective? Use my refer-a-friend link and enter the promo code ‘joshburnstech’ when signing up. You’ll get your first month free – at $349 value!

Just select ‘referral/word of mouth’ during the signup as well and mention my code. This way, whether you pick the monthly or annual plan, this deal helps you test out the platform risk-free.

The Most Comprehensive Collective Video Review!

Need a more in-depth review of Collective before signing up?

In this video, I share my personal experience using Collective to manage my S Corp.

They helped me restructure my LLC into an S Corp and take care of my bookkeeping, payroll, financial reporting, and everything else, freeing up more time for me to focus on growing my business.

Leave A Comment